I. Introduction

Illegal immigrants are individuals who are living in the United States without legal permission. They are not citizens or legal residents, and they do not have a social security number.

II. What is an illegal immigrant?

An illegal immigrant is an individual who is living in the United States without legal permission. They are not citizens or legal residents, and they do not have a social security number.

III. Why do illegal immigrants need to file taxes?

Illegal immigrants are required to file taxes just like any other resident of the United States. The IRS does not care about your immigration status, they just want you to pay your taxes.

IV. What are the different ways to file taxes for illegal immigrants?

There are a few different ways that illegal immigrants can file taxes. The most common way is to use an Individual Taxpayer Identification Number (ITIN). An ITIN is a tax identification number that is issued by the IRS to individuals who are not eligible for a social security number. Illegal immigrants can use an ITIN to file taxes, receive tax refunds, and open bank accounts.

V. What documents do you need to file taxes?

In order to file taxes as an illegal immigrant, you will need the following documents:

- Your ITIN

- Your Social Security number (if you have one)

- Your birth certificate

- Your driver’s license or other government-issued ID

- Your most recent tax return

VI. How do you file taxes if you are an illegal immigrant?

To file taxes as an illegal immigrant, you can use the following steps:

- Get an ITIN from the IRS.

- Gather the necessary documents.

- Complete and file your tax return.

- Receive your tax refund (if you are eligible).

VII. What are the benefits of filing taxes?

There are a number of benefits to filing taxes, even if you are an illegal immigrant. These benefits include:

- You may be eligible for a tax refund.

- You can claim certain credits and deductions.

- You can help to support the government programs that you use.

VIII. The risks of not filing taxes?

There are a number of risks associated with not filing taxes, even if you are an illegal immigrant. These risks include:

- You may be subject to penalties and interest.

- You may be barred from receiving certain government benefits.

- You may be deported.

IX. FAQ

Q: I am an illegal immigrant. Do I need to file taxes?

A: Yes, you do need to file taxes. The IRS does not care about your immigration status, they just want you to pay your taxes.

Q: I don’t have a social security number. How can I file taxes?

A: You can file taxes using an Individual Taxpayer Identification Number (ITIN). An ITIN is a tax identification number that is issued by the IRS to individuals who are not eligible for a social security number.

Q: I am eligible for a tax refund. Can I still get my refund if I am an illegal immigrant?

A: Yes, you can still get your tax refund if you are an illegal immigrant. However, you may be subject to certain penalties and interest.

Q: I am an illegal immigrant. What government benefits can I receive?

There are a number of government benefits that you may be eligible for, even if you are an illegal immigrant. These benefits include:

- Medicaid

- Supplemental Security Income (SSI)

- Food stamps

- Earned

Topic Answer I. Introduction This document provides information on how illegal immigrants can file taxes. II. What is an illegal immigrant? An illegal immigrant is a foreign national who is living in the United States without legal permission. III. Why do illegal immigrants need to file taxes? Illegal immigrants are required to file taxes in the same way as citizens and legal residents. IV. What are the different ways to file taxes for illegal immigrants? There are a few different ways that illegal immigrants can file taxes. II. What is an illegal immigrant?

An illegal immigrant is a foreign national who is living in the United States without authorization from the government. Illegal immigrants may have entered the country illegally or may have overstayed their visas.

III. Why do illegal immigrants need to file taxes?

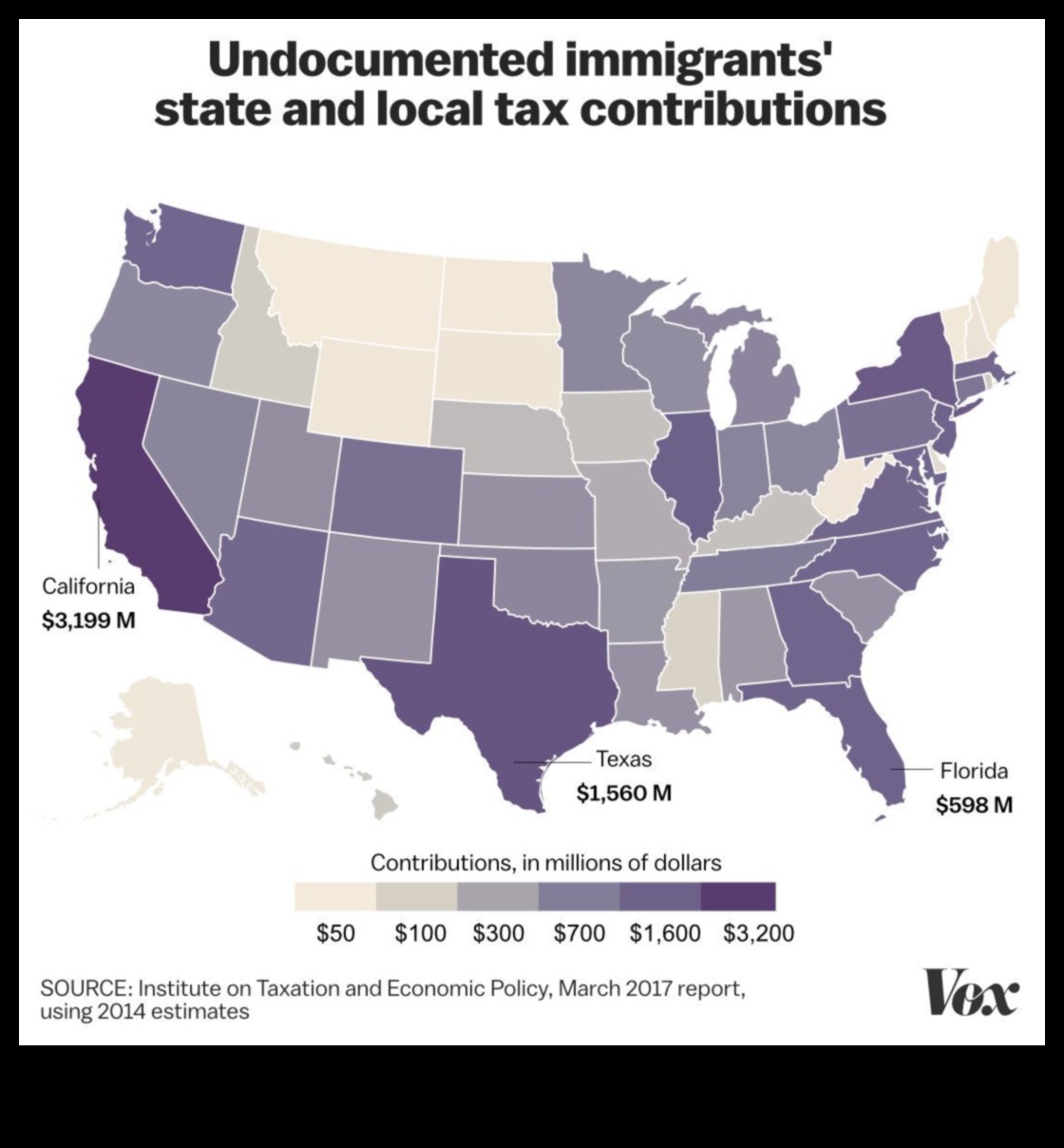

Illegal immigrants are required to file taxes for a number of reasons. First, the IRS requires all individuals who have earned income to file taxes. This includes illegal immigrants who have worked in the United States. Second, filing taxes can help illegal immigrants to claim tax refunds and other benefits. Third, filing taxes can help illegal immigrants to build a credit history, which can be helpful if they ever apply for a loan or credit card.

IV. What are the different ways to file taxes for illegal immigrants?

There are a few different ways that illegal immigrants can file taxes. The most common way is to use an Individual Taxpayer Identification Number (ITIN). An ITIN is a tax identification number that is issued by the IRS to individuals who are not eligible for a social security number. Illegal immigrants can use an ITIN to file taxes, receive tax refunds, and open bank accounts.

Another way that illegal immigrants can file taxes is to file their taxes using their alien registration number (A-number). An A-number is a unique identification number that is issued to all legal permanent residents and temporary residents. Illegal immigrants can use their A-number to file taxes, but they will not be eligible for any tax benefits.

Finally, illegal immigrants can also file their taxes using their driver’s license number. However, this is only possible if the driver’s license number is issued by a state that participates in the IRS’s Taxpayer Identification Number (TIN) Matching Program.

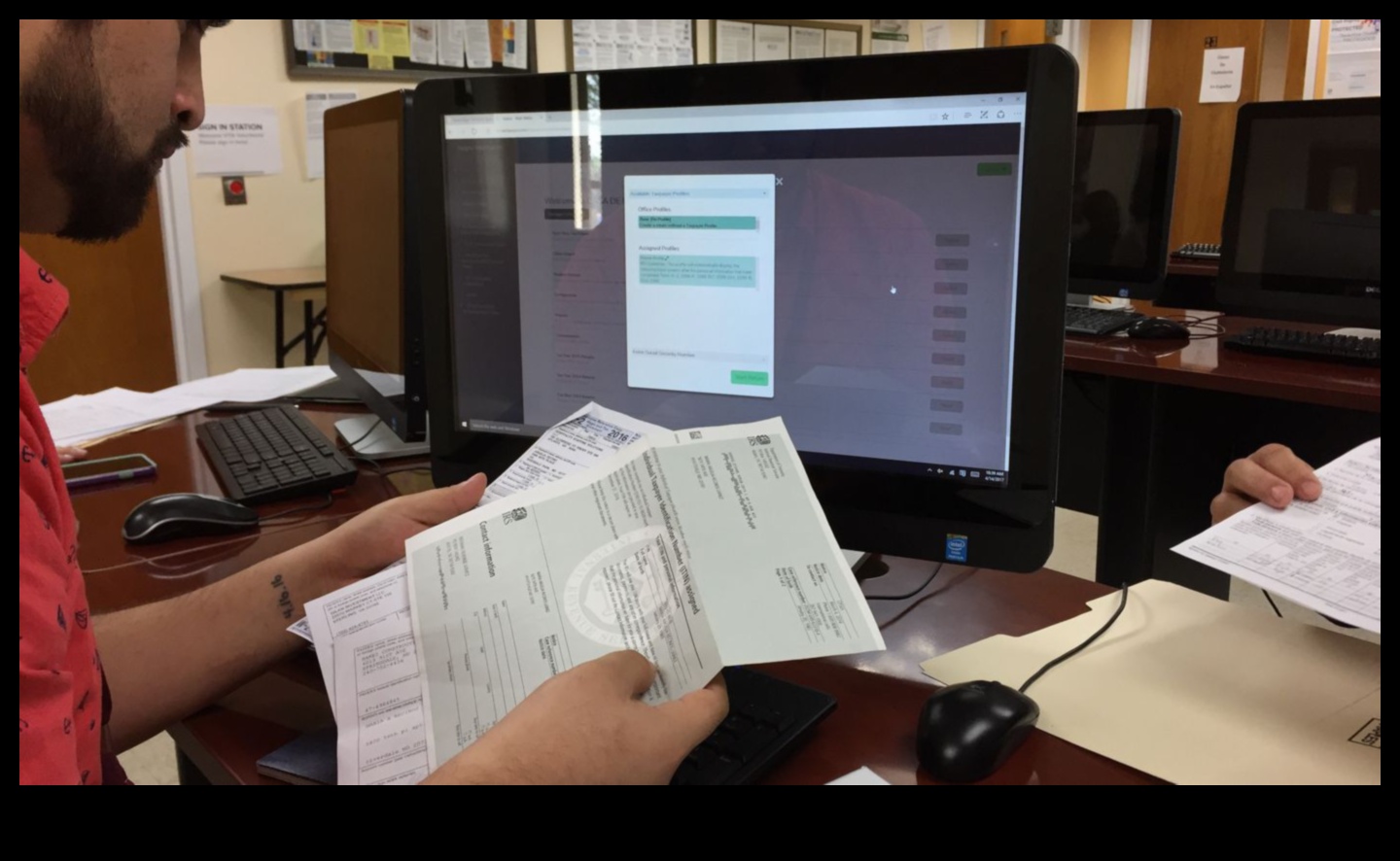

V. What documents do you need to file taxes?

In order to file taxes, you will need the following documents:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your driver’s license or other government-issued ID

- Your birth certificate or other proof of citizenship

- Your most recent tax return

- Your W-2 form from your employer

- Any other forms that you received from your employer or other sources of income

If you do not have all of these documents, you may be able to file your taxes using an alternative method, such as Form 1040-V. You can find more information about alternative filing methods on the IRS website.

VI. How do you file taxes if you are an illegal immigrant?

If you are an illegal immigrant, you can file taxes using an Individual Taxpayer Identification Number (ITIN). An ITIN is a tax identification number that is issued by the IRS to individuals who are not eligible for a social security number. You can apply for an ITIN online or by mail.

Once you have an ITIN, you can file your taxes using the same forms and procedures as citizens and legal residents. You will need to provide your name, address, and other identifying information, as well as your income and deductions.

You can file your taxes either electronically or by mail. If you file electronically, you will need to use the IRS Free File program. If you file by mail, you will need to use Form 1040NR, U.S. Nonresident Alien Income Tax Return.

The deadline for filing your taxes is April 15th. If you are unable to file your taxes by this date, you may be able to file for an extension.

If you have any questions about filing taxes as an illegal immigrant, you can contact the IRS for assistance.

VII. What are the benefits of filing taxes?

There are a number of benefits to filing taxes, even if you are an illegal immigrant. These benefits include:

- You may be eligible for a tax refund.

- You may be able to claim certain tax credits and deductions.

- Filing taxes can help you to establish a credit history, which can be helpful if you are trying to get a loan or rent an apartment.

- Filing taxes can help you to protect your rights as a worker.

If you are an illegal immigrant, you should still file your taxes. Even if you do not owe any taxes, filing your taxes can help you to protect your rights and access the benefits that you are eligible for.

Risks of not filing taxes

There are a number of risks associated with not filing taxes, including:

- You may be subject to penalties and interest charges.

- You may not be eligible for certain tax benefits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit.

- You may have difficulty getting a loan or mortgage.

- You may be denied government benefits, such as food stamps or unemployment benefits.

It is important to note that even if you are not required to file taxes, you may still want to do so in order to claim the tax benefits that you are eligible for.

FAQ

Q: What is an illegal immigrant?

A: An illegal immigrant is a foreign national who is living in the United States without legal permission.

Q: Why do illegal immigrants need to file taxes?

A: Illegal immigrants are required to file taxes just like any other resident of the United States.

Q: What are the different ways to file taxes for illegal immigrants?

A: There are a few different ways that illegal immigrants can file taxes. The most common way is to use an Individual Taxpayer Identification Number (ITIN).

Q: What documents do you need to file taxes?

A: You will need to provide your name, address, and date of birth. You will also need to provide your ITIN number, if you have one.

Q: How do you file taxes if you are an illegal immigrant?

You can file your taxes online, by mail, or by phone. You can find more information on how to file your taxes on the IRS website.

Q: What are the benefits of filing taxes?

There are a number of benefits to filing taxes, even if you are an illegal immigrant. Filing your taxes can help you to:

- Get a tax refund

- Qualify for certain government programs

- Protect your assets

Q: What are the risks of not filing taxes?

There are a number of risks to not filing taxes, including:

- You may owe back taxes and penalties

- You may be subject to criminal prosecution

- You may be denied certain government programs

FAQ Q: What is an illegal immigrant?

A: An illegal immigrant is a foreign national who is living in the United States without legal permission.Q: Why do illegal immigrants need to file taxes?

A: Illegal immigrants are required to file taxes just like all other residents of the United States.Q: What are the different ways to file taxes for illegal immigrants?

A: Illegal immigrants can file taxes using an Individual Taxpayer Identification Number (ITIN), a Social Security number, or a tax preparer.